“Discover how AI-powered insurance agents like Sales Closer AI are transforming insurance with personalized policy comparisons and enhanced customer support.”

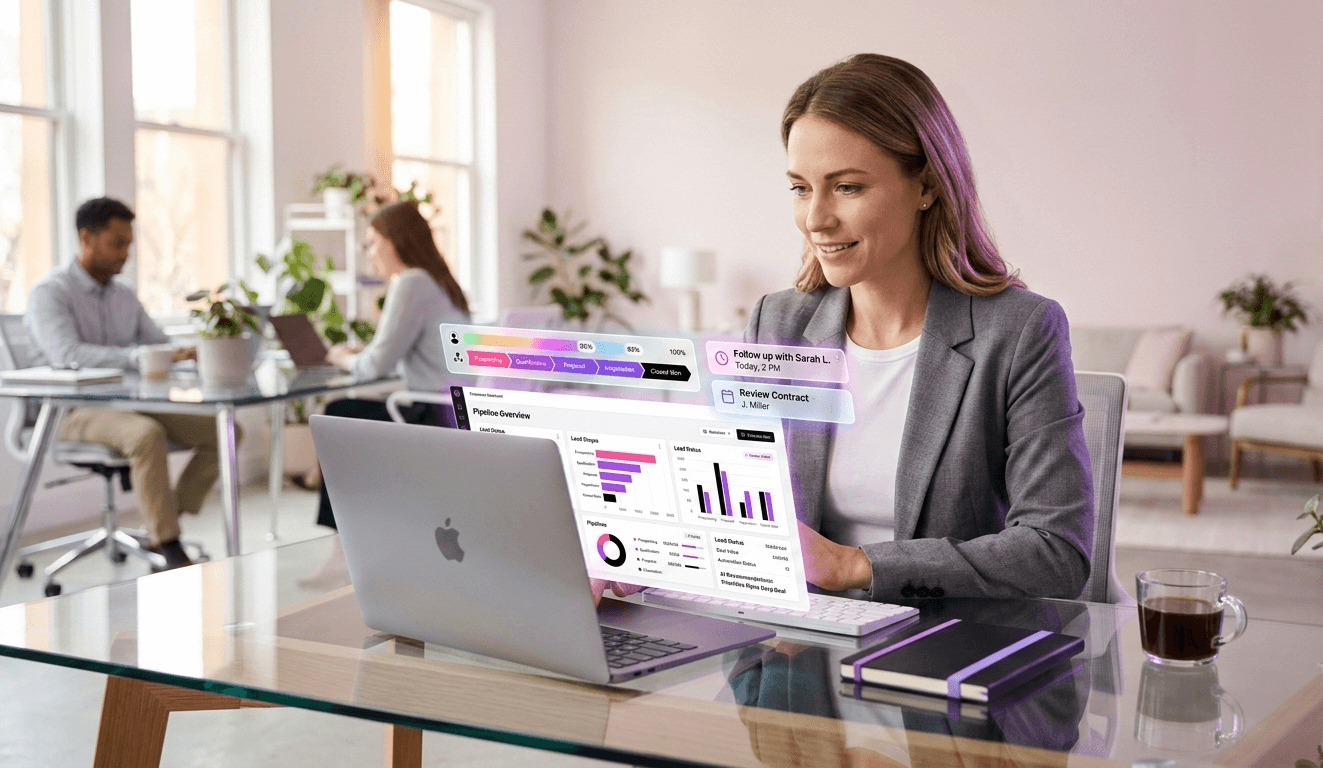

The insurance industry is evolving rapidly, and AI is at the forefront of this transformation. AI-powered tools have become game changers for insurance agents, enabling faster service, better customer support, and streamlined operations. Virtual insurance agents, driven by artificial intelligence, provide personalized policy comparisons, 24/7 customer assistance, and even handle lead generation—all key benefits that save time and boost productivity. This article explores how AI revolutionizes insurance, focusing on Sales Closer AI and its cutting-edge tools.

What is an AI-Powered Insurance Agent?

AI-powered insurance agents are virtual assistants that automate essential tasks. From policy comparisons to customer interactions, AI-driven tools handle various functions, allowing human agents to focus on more complex cases. These virtual agents offer unprecedented support by processing data faster, analyzing customer needs, and delivering tailored solutions in real time.

Sales Closer AI, for example, brings these capabilities to life with advanced features designed for the insurance industry. It acts as a virtual assistant for insurance agents, efficiently handling repetitive tasks, reducing workload, speeding up policy management, and leading qualification processes.

Personalized Policy Comparisons with AI

AI doesn’t just gather data—it interprets it in ways that can transform the customer experience. With personalized policy comparisons, AI-powered virtual agents help clients understand complex insurance offerings by analyzing their needs and preferences. Whether someone needs auto insurance or a more specialized health plan, AI tailors recommendations in seconds, highlighting key features, coverage options, and prices.

Sales Closer AI enhances this experience by integrating policy comparisons into its suite of features. It offers clear, side-by-side comparisons of various insurance policies, which helps agents serve their clients better and makes the decision-making process more accessible for customers.

AI in Customer Support: Beyond the Ordinary

One of the biggest challenges in the insurance industry is providing consistent and timely customer support. AI changes the game by delivering 24/7 assistance. Virtual agents can resolve routine queries, handle policy changes, and provide updates—without needing a break. This not only improves customer satisfaction but also reduces the workload on human agents.

Sales Closer AI takes customer support to the next level by offering a seamless experience across multiple communication channels. Its AI-enhanced customer support feature engages clients through chat, email, and voice platforms, offering fast and accurate responses. This frees your team to focus on more critical tasks, ultimately improving service delivery.

Leveraging Multilingual AI for Global Insurance Services

Insurance is a global industry, and one significant hurdle for agents is handling clients who speak different languages. With AI-powered virtual agents, language barriers become a thing of the past. Multilingual capabilities enable AI to communicate with clients in their preferred language, expanding an insurance agent’s reach across borders and demographics.

Sales Closer AI stands out with its robust multilingual functionality, enabling insurance businesses to scale internationally without hiring specialized agents for each language. From policy explanations to customer support, these AI tools ensure consistent communication regardless of language.

How AI Integrates with Existing Systems

Integrating AI into current systems might seem overwhelming for any insurance agency. However, modern AI tools like Sales Closer AI are designed for easy integration. Whether your agency uses a CRM system, a policy management platform, or an underwriting tool, AI can seamlessly fit into the existing workflows, automating repetitive tasks without disrupting current operations.

Sales Closer AI offers customized integrations that align with your current software, automating tasks that typically slow agents down. This not only streamlines operations but also drives significant cost savings. For instance, insurers using AI in underwriting and customer support, like Allianz, have reported a reduction in operational costs by up to 50% and revenue growth of 15% in some markets(Arya AI Blog)(Binariks).

How Sales Closer AI Helps Insurance Agents

Sales Closer AI is built to cater specifically to the needs of insurance agents. The platform provides tools to improve client interactions, enhance lead generation, and speed up the sales cycle. Some key features include:

- 24/7 Customer Support: Take advantage of every opportunity to engage with clients. Sales Closer AI handles customer inquiries and provides real-time responses around the clock.

- Multilingual Support: Serve clients from different backgrounds by offering AI-powered communication in multiple languages.

- Lead Generation: Identify high-quality leads using AI-driven insights, streamlining the process of qualifying potential clients.

- Automated Policy Comparisons: Help clients make informed decisions by offering tailored policy options without the manual workload.

Transformations Achieved with Sales Closer AI

Insurance agents implementing AI tools like Sales Closer AI have reported significant business transformations. Some benefits are increased productivity, enhanced customer service, and more efficient lead generation. For example, Sales Closer AI agents can handle more clients at once, reduce the time spent on repetitive tasks, and close deals faster.

Insurance businesses can also reduce overhead costs by integrating AI into everyday operations. Automating customer support and lead qualification minimizes the need for extra staff, making it a cost-effective solution for growing agencies.

Conclusion

AI is no longer a futuristic concept—it’s a tool transforming insurance businesses’ operations. From policy comparisons to customer support and lead generation, AI-powered insurance agents, like those offered by Sales Closer AI, bring efficiency, accuracy, and scalability to the table. As the insurance industry evolves, staying competitive means adopting these cutting-edge tools to serve clients better and streamline internal operations.

For more information about how Sales Closer AI can revolutionize your insurance agency, explore their use cases, or schedule a demo today.